The Bank of England just threw cold water on rate cut hopes. With inflation still running hot at 3.8%, the MPC voted 7-2 to keep interest rates locked at 4% whilst also pumping the brakes on their gilt-selling spree.

A kicker: they’re also dialling back quantitative tightening from £100bn to £70bn annually. Why? Because dumping government bonds into already jittery markets isn’t exactly helping Chancellor Rachel Reeves sleep better at night.

Interest Rates Stay Put Despite Economic Headwinds

The Bank of England’s decision wasn’t exactly shocking, but the reasoning tells a story. Governor Andrew Bailey made it clear: “We’re not out of the woods yet” when it comes to hitting that 2% inflation target.

Current inflation sits at 3.8% – nearly double where it should be. Food prices have been climbing for five straight months, and services inflation remains stubborn despite some cooling.

Only two MPC members pushed for a 25 basis point cut: Swati Dhingra and Alan Taylor. They pointed to weakening job markets (142,000 jobs vanished in the past year) and slowing wage growth as reasons to ease up.

But the majority wasn’t buying it. With inflation expectations still “elevated relative to historical averages,” most policymakers decided patience beats panic.

QT Gets a Haircut: From £100bn to £70bn

The Bank slashed its quantitative tightening target by 30% for the next 12 months.

Why the sudden change of heart? Bond markets are already under pressure, and continuing to flood them with gilt sales would be like adding fuel to a fire that’s already scorching the Treasury’s borrowing costs.

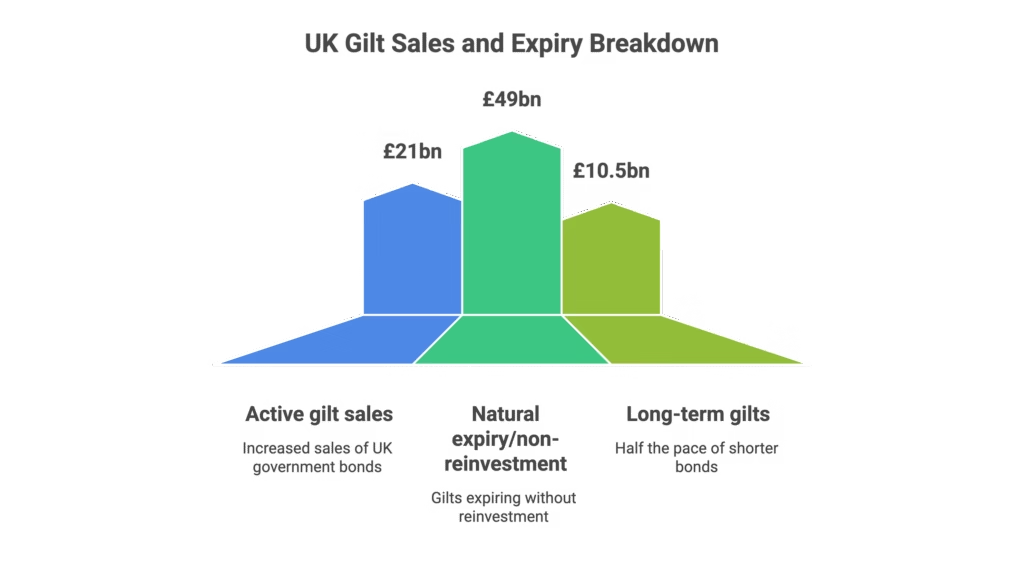

The new breakdown:

- Active gilt sales: £21bn (up from £13bn)

- Natural expiry/non-reinvestment: The remaining £49bn

- Long-term gilts: Half the pace of short and medium-term bonds

The timing couldn’t be more awkward for Reeves – the Bank’s first long-term gilt sale hits just two weeks before her Autumn Budget.

What This Means for Your Wallet

Higher borrowing costs aren’t going anywhere fast. The Office for Budget Responsibility is expected to forecast even steeper government borrowing costs later this year, which likely means more tax hikes are coming.

Shadow Chancellor Mel Stride didn’t hold back, calling Labour’s policies “reckless decisions” that have pushed up inflation and created “deep nervousness” about the UK’s economic direction.

For regular folks? Mortgage rates probably aren’t dropping anytime soon, and the cost of living squeeze continues.

The Bottom Line

The Bank of England is playing it safe – perhaps too safe for some. They’re caught between persistent inflation and a weakening economy, choosing to err on the side of caution.

With gilt markets already stressed and the Chancellor facing a tough Budget, expect this cautious approach to continue. Rate cuts might be on the horizon, but they’ll come “gradually and carefully” – Bank speak for “don’t hold your breath.”

Ready to stay ahead of the next Bank of England decision? Keep an eye on inflation data and gilt yields – they’re your best crystal ball for what comes next.

FAQ

Q1: When will the Bank of England cut interest rates?

A: Most economists expect the first cut in November, potentially taking rates to 3.75%. However, with inflation still at 3.8%, any cuts will be gradual and data-dependent.

Q2: Why did the Bank reduce quantitative tightening?

A: Gilt markets are already under pressure, pushing up government borrowing costs. Selling fewer bonds gives markets breathing room and helps the Treasury manage its debt burden more effectively.

Q3: What does this mean for mortgage rates?

A: Mortgage rates are likely to stay elevated in the near term. With the Bank holding rates steady and bond yields rising, cheap borrowing remains off the table for now.

Q4: How is inflation still so high?

A: Food prices have risen for five consecutive months, and services inflation remains sticky despite some cooling. Wage pressures and elevated inflation expectations are keeping prices above the 2% target.

Q5: Will there be more tax rises after the Budget?

A: Very likely. Higher government borrowing costs mean the Chancellor needs to find extra revenue somewhere, and tax hikes remain the most direct tool available.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.