Even though cryptocurrency ownership has exploded 8x since 2018, most Americans still won’t touch it. A fresh Gallup survey shows only 14% of U.S. adults own cryptocurrency, whilst 60% have zero interest in buying any. Despite all the Bitcoin ETFs and institutional adoption, the “very risky” label isn’t going anywhere – 64% of investors still see crypto as a dangerous bet. So what’s keeping mainstream America on the sidelines?

Crypto Adoption Hits a Wall

The latest Gallup data paints a clear picture of crypto’s uphill battle for mainstream acceptance. Whilst ownership jumped from a measly 2% in 2018 to 17% amongst investors with $10,000+ portfolios, that’s still a tiny slice of the pie.

Here’s what’s really telling: only 4% of Americans plan to buy crypto soon, and just 17% admit they’re even curious about it. Compare that to traditional investments – nearly six in 10 Americans own stocks or real estate.

The trust factor? Still broken. Only 35% of survey respondents said they actually understand how cryptocurrency works, even though nearly everyone has heard of it.

Who’s Actually Buying Crypto (And Who Isn’t)

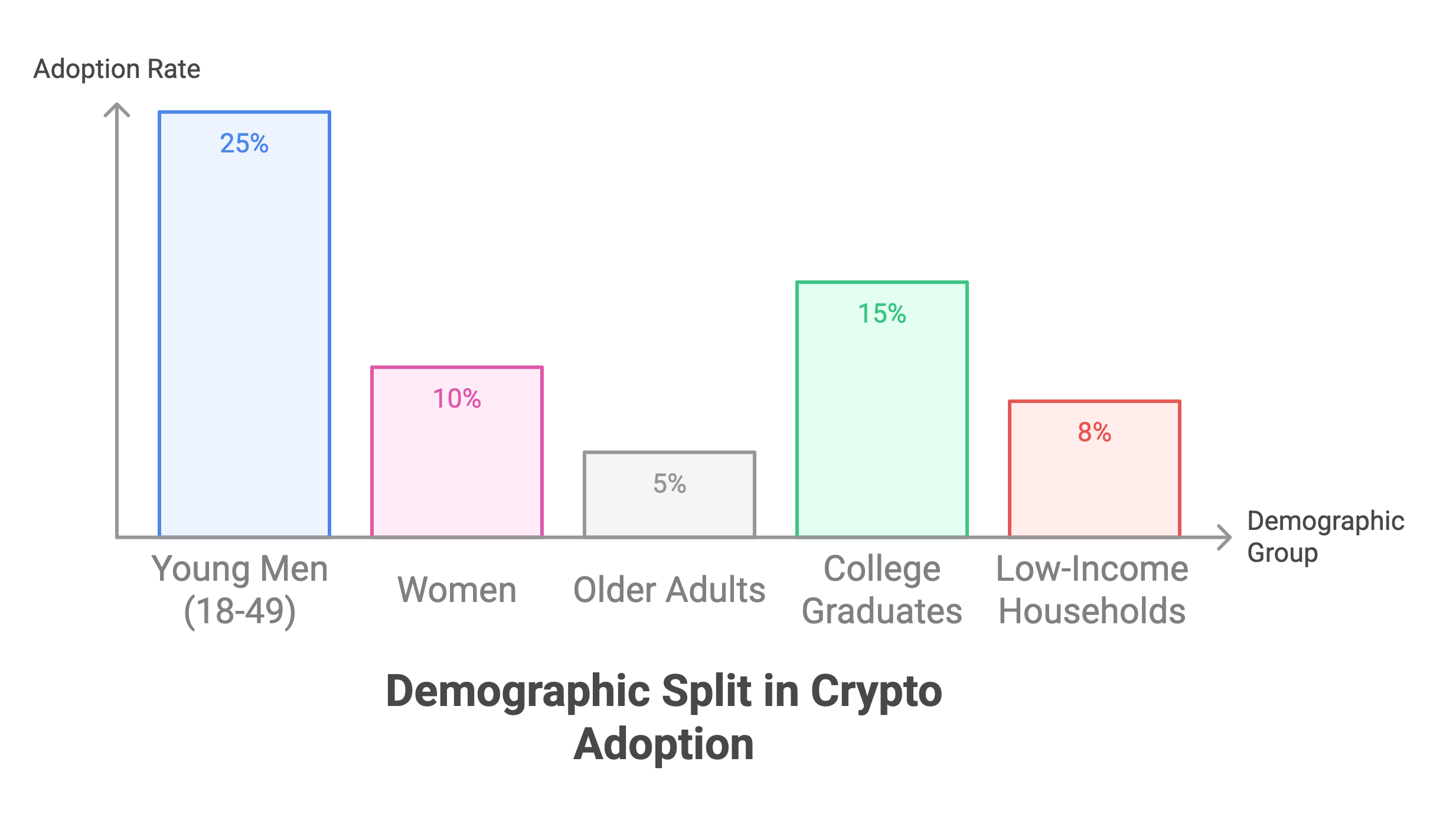

The demographic split is stark, and it follows predictable lines:

The Crypto Crowd:

- Young men (18-49): 1 in 4 owns crypto

- College graduates and high earners lead adoption

- Tech-savvy millennials driving growth

The Skeptics:

- Women remain underrepresented

- Older adults largely absent from the space

- Low-income households staying away

This isn’t just about risk tolerance – it’s about access, education, and trust. When you’ve watched FTX collapse and countless crypto scams make headlines, skepticism makes sense.

Why the “Very Risky” Label Sticks

Even with a pro-crypto president and clearer regulations rolling out, Americans aren’t forgetting the crypto winter of 2022. The brutal crashes, high-profile bankruptcies, and endless scam stories left scars.

The perception of risk has actually gotten worse. Back in 2021, 60% of investors called crypto “very risky.” Now? That number’s climbed to 64%.

Sure, institutional money is flooding in and Bitcoin ETFs are mainstream, but retail investors who got burned are staying cautious.

The Bottom Line

Crypto has come a long way since 2018, but it’s still fighting an uphill battle for mainstream acceptance. Whilst ownership has grown dramatically, the vast majority of Americans remain sceptical, uninformed, or simply uninterested.

For crypto to truly go mainstream, it needs to solve the trust problem – not just the technology problem. Until then, expect slow and steady growth rather than explosive adoption.

FAQ

Q1: What percentage of Americans actually own cryptocurrency?

A: According to the latest Gallup survey, only 14% of U.S. adults own crypto. Among investors with portfolios over $10,000, that number rises to 17%.

Q2: Why do most Americans still consider crypto “very risky”?

A: 64% of U.S. investors view crypto as very risky, largely due to the 2022 crypto winter, high-profile bankruptcies like FTX, and ongoing volatility. The perception has actually worsened since 2021.

Q3: Who is most likely to own cryptocurrency?

A: Young men aged 18-49 lead adoption (25% ownership rate), along with college graduates and high-income earners. Women, older adults, and low-income households remain largely absent from crypto investing.

Q4: How much has crypto ownership grown since 2018?

A: Crypto ownership among U.S. investors has skyrocketed from just 2% in 2018 to 17% today – an 8x increase over six years.

Q5: Do most Americans understand how cryptocurrency works?

A: No. While nearly everyone has heard of crypto, only 35% say they actually understand how it works. This knowledge gap is a major barrier to adoption.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.