Introduction

Hong Kong’s about to make history. In March 2026, the Hong Kong Monetary Authority (HKMA) will approve its first stablecoin licenses—a milestone seven months in the making. After rolling out one of the world’s toughest stablecoin frameworks in August 2025, regulators are finally ready to hand out the golden tickets. But here’s the catch: only a handful of carefully vetted applicants will make the cut. Think rigorous risk checks, bulletproof anti-money laundering (AML) protocols, and rock-solid reserve backing. If you’re expecting a free-for-all, think again.

Hong Kong’s Stablecoin Licensing: What’s Taking So Long?

The Regulatory Runway

At a Legislative Council meeting on Monday, HKMA chief Eddie Yue dropped the news: the review process is nearly done. Out of 36 applications in the first round—down from over 40 initial expressions of interest—only a “very small number” will get approved initially.

Why so selective? Yue’s team is laser-focused on core criteria: stablecoin use cases, reserve quality, risk management frameworks, and AML compliance. Translation: if your paperwork isn’t perfect, you’re out.

What the Rules Actually Require

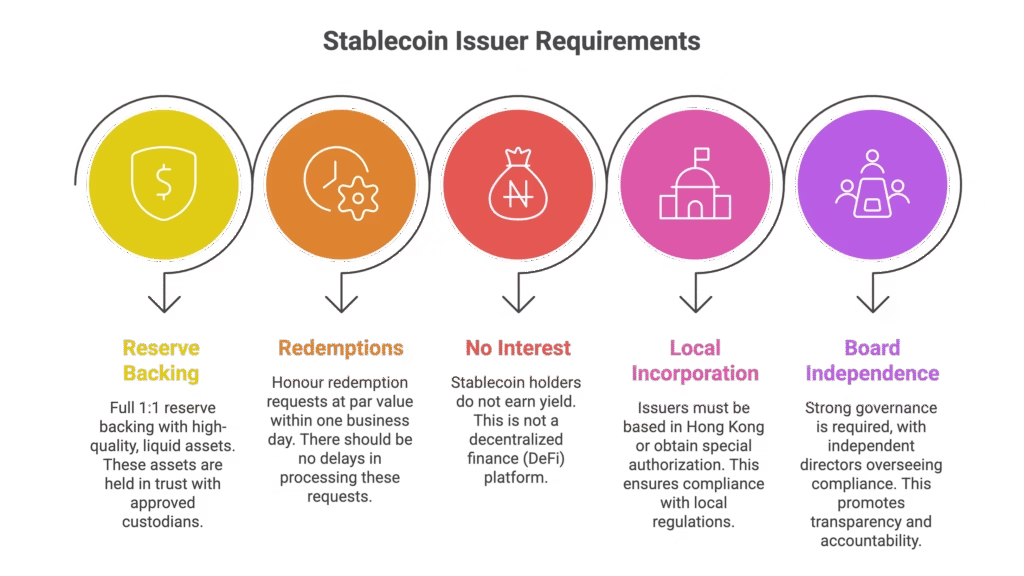

Hong Kong’s stablecoin regime isn’t messing around. Here’s what issuers need to tick off:

- Full 1:1 reserve backing: High-quality, liquid assets held in trust with approved custodians

- One-day redemptions: Honour requests at par value within one business day—no delays

- No interest payments: Stablecoin holders don’t earn yield (this isn’t DeFi)

- Local incorporation: Issuers must be based in Hong Kong or get special authorisation

- Board independence: Strong governance with independent directors overseeing compliance

The HKMA can also slap on extra license conditions, appoint managers, or revoke licenses if things go sideways. This isn’t a “set it and forget it” approval.

Who’s Actually Applying?

The Big Names in the Sandbox

Several heavyweight players have already thrown their hats in the ring via the HKMA’s regulatory sandbox:

Anchorpoint Financial: A joint venture between Standard Chartered Hong Kong, Animoca Brands, and telecoms giant HKT. That’s traditional banking, Web3 gaming, and telco infrastructure in one package.

Ant Group: The fintech behemoth behind Alipay is pursuing a license through its digital tech unit.

Bank of China Hong Kong: Reports suggest they’re in the mix, alongside rumored applications from HSBC and ICBC.

The kicker: the HKMA hasn’t confirmed any applicant names officially and warns that early approvals aren’t endorsements of specific business models. In other words, getting a license doesn’t mean the regulator thinks your product is the next big thing.

Hong Kong’s Bigger Crypto Play

Building a Digital Asset Ecosystem

Stablecoins are just one piece of Hong Kong’s broader crypto strategy. The city already runs a licensing regime for virtual asset trading platforms under the Securities and Futures Commission (SFC), with 11 exchanges approved so far—including OSL, HashKey, and Bullish.

Government officials keep framing stablecoins as infrastructure, not speculative tokens. At Davos in January, Financial Secretary Paul Chan called Hong Kong’s approach “responsible and sustainable,” positioning digital finance as a strategic growth pillar.

The Compliance Cost Conundrum

Not everyone’s cheering. Industry groups have flagged concerns that sky-high compliance costs could scare off institutional players if regulations get too restrictive. It’s the classic balancing act: protect consumers without strangling innovation.

What Happens Next?

March 2026 marks the starting gun, not the finish line. The first wave of licenses will be small and cautious—regulators want to see how issuers perform under real-world conditions before opening the floodgates.

For now, the HKMA’s public registry of licensed stablecoin issuers sits empty. But once those first approvals land, expect close scrutiny from global regulators watching how Asia’s financial hub handles digital dollars.

If you’re bullish on regulated crypto infrastructure, Hong Kong just became a city to watch.

FAQ

Q1: When will Hong Kong approve its first stablecoin licenses?

A: The HKMA plans to issue the first licenses in March 2026. Only a small number of applicants from the initial pool of 36 will be approved in the first round.

Q2: What are the main requirements for getting a stablecoin license in Hong Kong?

A: Issuers need full 1:1 reserve backing with high-quality assets, one-day redemption capabilities, strong AML controls, local incorporation, and independent board oversight. Interest payments to holders are prohibited.

Q3: Which companies are applying for Hong Kong stablecoin licenses?

A: Known applicants include Anchorpoint Financial (Standard Chartered, Animoca Brands, HKT joint venture), Ant Group’s digital tech unit, and reportedly Bank of China Hong Kong. HSBC and ICBC have also signaled interest.

Q4: How does Hong Kong’s stablecoin framework compare globally?

A: It’s one of the most comprehensive regimes worldwide, implemented in August 2025. The framework covers all fiat-referenced stablecoins issued in Hong Kong and foreign issuers of HKD-pegged tokens.

Q5: Can stablecoin issuers pay interest to holders in Hong Kong?

A: No. Under the current rules, licensed stablecoin issuers are prohibited from paying interest to token holders.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.