Introduction

UK consumer confidence has just hit its lowest point in two years, and Britons are more worried about their finances than they’ve been since December 2023. According to S&P Global’s latest survey, Rachel Reeves’ November Budget didn’t just fail to reassure households, it’s actively spooked them. With extra taxes on the horizon and spending power shrinking, confidence levels have now dropped for three months straight. Even London, typically the UK’s economic bright spot, is seeing its gloomiest outlook in 24 months.

UK Households Are Feeling the Squeeze

The numbers paint a pretty bleak picture. S&P Global’s consumer sentiment index came in at 44.7 in December, well below the 50-mark that signals neutral confidence. The household finance index? Even worse at 42.4, with expectations for the next 12 months dropping to 44.2.

Here’s what’s really hurting families right now: less cash to spend and more debt piling up. Households are reporting that their current financial conditions are deteriorating at an accelerating rate.

S&P Global economist Maryam Balunch didn’t mince words: “Sentiment towards the financial outlook over the coming 12 months has soured to the gloomiest in two years.” Translation? Don’t expect consumers to prop up the economy heading into 2026.

Why the Budget Backfired

The late November Budget was supposed to calm nerves. Instead, it amplified them. Britons looked at the tax hikes and spending plans and decided their wallets would be taking a hit, not getting relief.

Only London managed to keep household expectations in positive territory, but even the capital isn’t celebrating. Negative sentiment levels there are still at their worst in two years, which tells you everything about the national mood.

The reality? When people feel financially squeezed, they pull back on spending. And when consumer spending drops, the entire economy feels it.

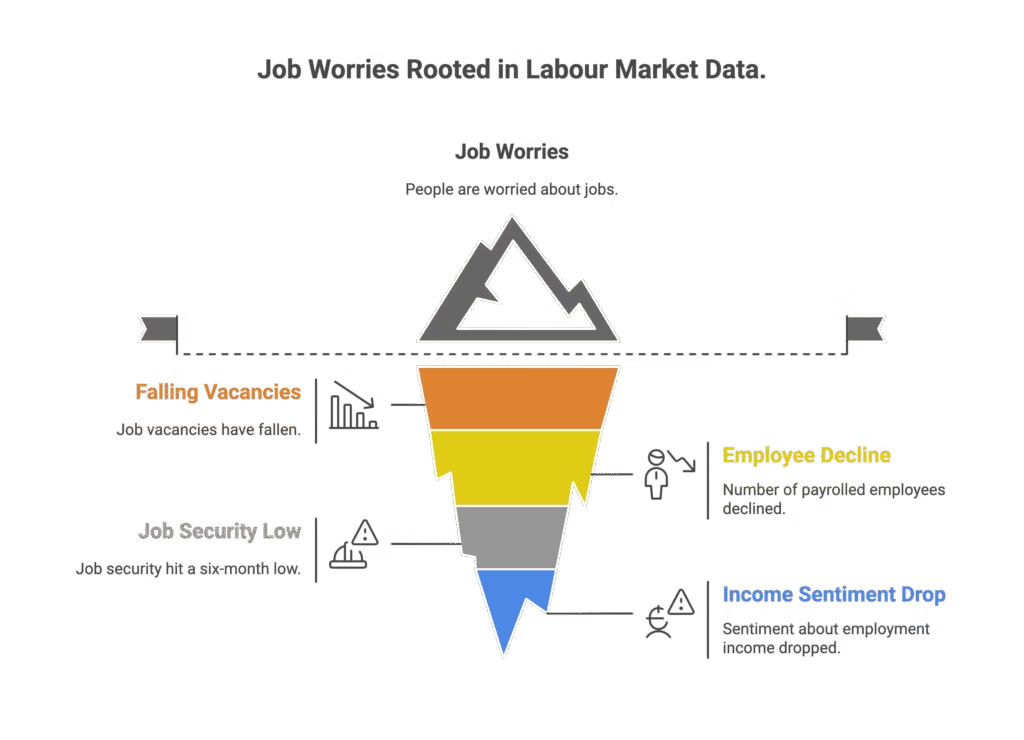

Job Security Fears Are Rising Fast

It’s not just about household budgets, people are genuinely worried about their jobs. The UK labour market data backs up these fears:

- Job vacancies have fallen for 39 consecutive three-month periods

- The number of payrolled employees has declined over the past year

- Job security hit a six-month low in December

- Sentiment about employment income dropped to a nine-month low

The sectors feeling the most pain? IT, construction, and financial services are seeing the highest levels of job insecurity. Interestingly, higher earners are feeling more secure than those on lower incomes—a split that could widen economic inequality further.

This comes despite recent periods of strong private sector wage growth, which suggests that pay rises aren’t enough to offset broader economic anxiety.

What This Means for the UK Economy

When consumer confidence tanks like this, it creates a ripple effect. Households cut back on discretionary spending. Businesses see lower demand. Companies then hesitate to hire or invest. It’s a cycle that’s tough to break.

The deteriorating financial environment means spending intentions have worsened across the board. With less cash available and more people taking on debt just to make ends meet, the economy is unlikely to get much of a boost from consumer spending in 2026.

For policymakers, this is a warning sign. The Budget hasn’t delivered the reassurance voters needed, and the numbers suggest that households are bracing for tougher times ahead rather than preparing to spend their way out of economic uncertainty.

The Bottom Line

UK consumer confidence is at a two-year low, household finances are under serious pressure, and job security fears are climbing. The Budget that was meant to ease cost of living concerns has instead left Britons more pessimistic about the year ahead. With spending power shrinking and debt rising, don’t expect consumers to fuel economic growth anytime soon. If you’re watching the UK economy, this confidence slump is your canary in the coal mine and it’s singing a pretty gloomy tune.

Want to stay ahead of UK economic trends? Keep an eye on monthly confidence surveys—they’re often the first signal of bigger shifts coming down the pipeline.

FAQ

Q1: Why has UK consumer confidence fallen to a two-year low?

A: Consumer confidence dropped sharply following Rachel Reeves’ November Budget, which failed to reassure households about cost of living pressures. Instead of relief, Britons are facing expectations of higher taxes and continued financial strain, leading to three consecutive months of declining confidence. The sentiment index now sits at 44.7, well below the neutral 50-mark.

Q2: Which regions of the UK are most affected by falling confidence?

A: Every UK region is experiencing negative sentiment, but London is the only area where household expectations remain marginally positive—though even there, negativity is at its worst level in two years. Outside the capital, pessimism about the next 12 months is even more pronounced, reflecting widespread concern about the economic outlook.

Q3: Why are people worried about job security right now?

A: Job vacancies have declined for 39 straight three-month periods, and the number of payrolled employees has fallen over the past year. Workers in IT, construction, and financial services are particularly anxious, with job security hitting a six-month low despite recent wage growth. The combination of economic uncertainty and Budget tax changes has made people nervous about employment stability.

Q4: How does falling consumer confidence affect the UK economy?

A: When confidence drops, households cut back on spending to protect their finances, which reduces demand for goods and services. This creates a knock-on effect: businesses see lower sales, leading them to delay hiring and investment, which further weakens economic growth. With spending intentions worsening, consumer activity is unlikely to boost the economy heading into 2026.

Q5: What’s driving the deterioration in household finances?

A: Households are reporting less cash available to spend and an increased need to take on debt just to manage day-to-day expenses. This squeeze comes from a combination of persistent cost of living pressures, anticipated tax increases from the Budget, and broader economic uncertainty. The household finance index dropped to 42.4, reflecting these mounting financial strains.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.