Introduction

Remember when M&S was finally cool again? Well…

The retailer just released the full damage report from April’s cyber attack, and it’s eye-watering: £136m by 2026. That’s after £100m in insurance payouts, meaning the actual hit could’ve topped £236m.

For a company that spent years clawing back from “dowdy” to “darling,” this couldn’t have come at a worse time. Online orders? Suspended for nearly two months. Click and collect? Down for almost four months. And the fashion side of the business — the part that was supposed to prove M&S had finally figured out style — took the biggest beating.

Let’s break down what went wrong, what it cost, and whether M&S can bounce back.

The Damage in Numbers

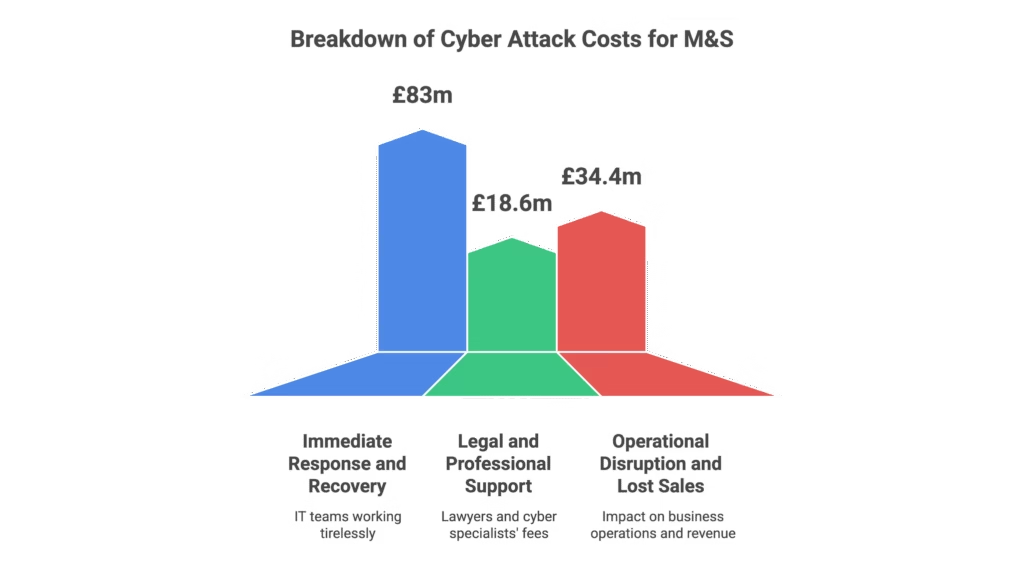

M&S didn’t hold back in its report. The £136m cyber attack cost breaks down like this:

- £83m on immediate response and recovery (IT teams working round the clock)

- £18.6m on legal and professional support (lawyers and cyber specialists don’t come cheap)

- The rest on operational disruption and lost sales

Profit before tax dropped by £229m — falling from £413.1m to just £184.1m in the 26 weeks ending September 27. That’s more than half their profit, gone.

Fashion, home, and beauty sales? Down 16.4%. International sales slid 11.6%. The only bright spot was food, which climbed 7.8% thanks to improved value perception. Turns out people still trust M&S for their Percy Pigs, even if they’re not clicking “buy now” on that blazer.

Why Fashion Got Hit Hardest

Food sales happen in-store. Fashion? That’s increasingly online.

When M&S pulled the plug on e-commerce for weeks, fashion shoppers didn’t wait around. They went to Zara, ASOS, Next — anywhere that had a working checkout button. And even after the site came back online, customers were slow to return.

M&S admitted as much: “As we have rebuilt online customer traffic in Fashion, Home & Beauty, recovery has been slower.”

Translation: trust is harder to rebuild than a website.

The company’s CEO, Stuart Machin, tried to stay upbeat, calling it an “extraordinary moment in time” and promising M&S would be “recovered and back on track” by spring next year. But analysts aren’t totally convinced. Peel Hunt noted that “uncertainty remains,” and eToro’s Mark Crouch summed it up perfectly: “2025 now looks like a year of what-ifs.”

What This Means for M&S’ Turnaround

Before April, M&S was on fire (in a good way). The brand had finally ditched its frumpy image, revamped its fashion lines, and was winning back younger shoppers. The share price reflected that momentum.

Interestingly, M&S shares barely budged after the announcement — down just 1% in early trading. Why? Because the market had already priced in the bad news. M&S pre-warned investors that the cyber attack could cost up to £300m, so £136m (plus insurance) almost felt like good news by comparison.

Still, this sets the turnaround back. The fashion recovery was supposed to be the proof that M&S had cracked the code. Now? It’s back to square one in some ways, rebuilding customer confidence and online traffic while competitors sprint ahead.

Can M&S Bounce Back?

The good news: M&S expects to match last year’s profit in the next six months, despite the cyber attack hangover. That’s ambitious, but the food business is holding steady, and the operational side is mostly recovered.

The bad news: fashion is still lagging, and consumer trust takes time to rebuild. Cyber attacks leave scars — not just on balance sheets, but on brand perception. If customers feel their data isn’t safe, they’ll shop elsewhere.

M&S needs to lean hard into transparency, security upgrades, and maybe some killer promotions to lure shoppers back online. The infrastructure is fixed, but the psychology? That’s the harder part.

Conclusion

M&S’ cyber attack is a brutal reminder that digital infrastructure isn’t optional, it’s mission-critical. A £136m bill and a halved profit later, the retailer is still standing, but the momentum it worked so hard to build has taken a serious hit.

The comeback isn’t over, but it’s on pause. Spring next year will be the real test. Can M&S regain customer trust and reignite its fashion business, or will this become the hack that stalled Britain’s most unlikely retail revival?

Want to stay updated on M&S and retail sector news? Bookmark this page and check back for the latest insights.

FAQ

Q1: How much did the M&S cyber attack cost?

A: The total cost is £136m by 2026, including £83m for recovery teams and £18.6m for legal support. M&S also received £100m in insurance payouts, meaning the gross impact was closer to £236m.

Q2: When did the M&S cyber attack happen?

A: The attack occurred in April. M&S suspended online orders for nearly two months and click-and-collect services for almost four months.

Q3: How did the cyber attack affect M&S profits?

A: Profit before tax dropped by £229m — falling from £413.1m to £184.1m in the 26 weeks ending September 27. Fashion sales fell 16.4%, while food sales rose 7.8%.

Q4: Why did M&S shares not crash after the announcement?

A: M&S had pre-warned the market that the cyber attack could cost up to £300m, so the actual £136m figure was already priced in. Shares fell just 1% in early trading.

Q5: Will M&S recover from the cyber attack?

A: M&S expects to be “back on track” by spring next year and anticipates matching last year’s profit despite the attack. However, fashion sales recovery has been slower than food, and customer trust remains a challenge.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.