BMW Joins the Motor Finance Mess

BMW just threw another £206m into the motor finance scandal pot. That’s nearly triple what they set aside last year.

The German carmaker’s UK finance arm is bracing for a potential hit from what’s shaping up to be one of the biggest mis-selling scandals since PPI. And they’re not alone – virtually every major lender and car company is scrambling to cover their backs.

Here’s the deal: millions of drivers might be owed compensation because they weren’t properly told about commission arrangements when buying their cars on finance.

The Supreme Court Opened the Floodgates (Sort Of)

Back in July, the Supreme Court delivered a mixed verdict that left everyone scratching their heads.

Two lenders won their appeals, which initially looked like good news for the industry. But then the court sided with one claimant, essentially saying “actually, some of these claims might have legs.”

It’s like winning 2-1 but knowing the other team still has a penalty to take.

FCA Steps In: £950 Per Customer on the Table

The Financial Conduct Authority isn’t messing around. They’re rolling out an industry-wide compensation scheme next year after admitting a “large number of consumers” got a raw deal.

The watchdog estimates payouts could hit £950 per customer. That’s real money for millions of drivers who financed their cars through dodgy commission arrangements.

FCA boss Nikhil Rathi told MPs the consultation ends in early October, with compensation payments starting in 2025.

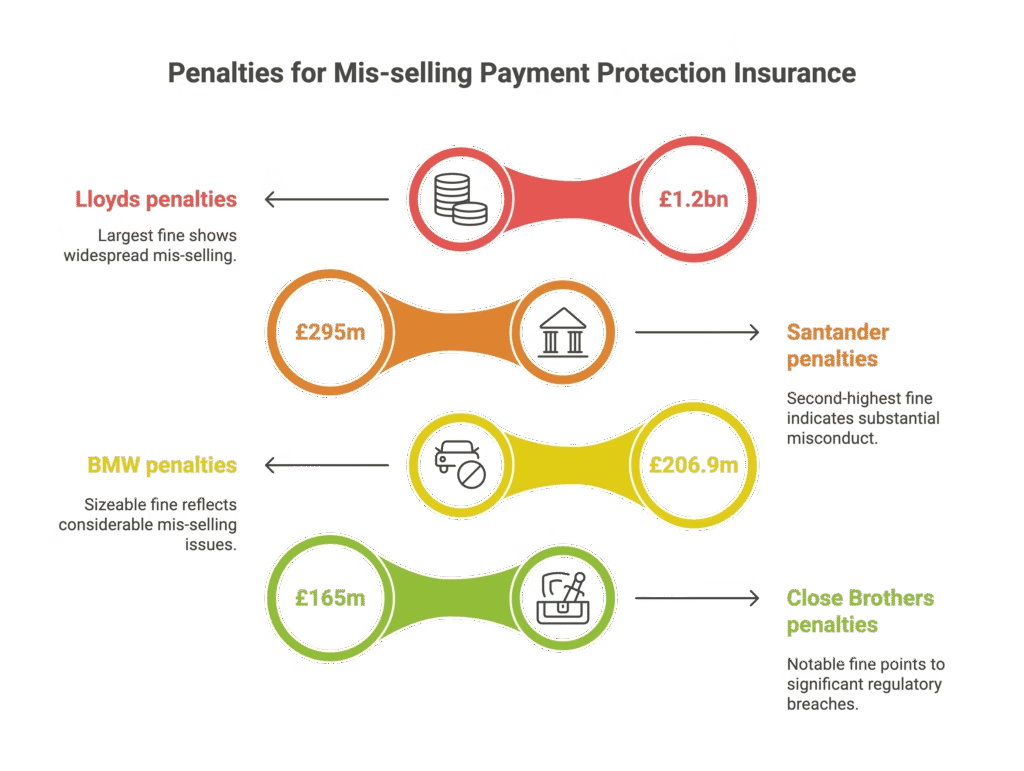

Who’s Paying What? The Provision League Table

BMW’s £206.9m provision puts them in the middle of the pack:

- Lloyds: £1.2bn (ouch)

- Santander: £295m

- BMW: £206.9m

- Close Brothers: £165m

But BMW warns there’s “considerable uncertainty” – final costs could be much higher or lower depending on how the FCA’s scheme shakes out.

The Co-operation Game

When pressed about which firms aren’t playing ball, the FCA’s Rathi stayed diplomatic. But he did hint that some companies are “raising questions” about the compensation scheme.

Translation: not everyone’s happy about writing massive cheques.

The regulator’s walking a tightrope here. They want fair compensation but don’t want to bankrupt lenders or drive them out of the market. That would just make car finance more expensive for everyone.

What Happens Next?

The FCA consultation wraps up in October. Then it’s a waiting game until the compensation scheme launches next year.

If you bought a car on finance and suspect you weren’t told the full story about commissions, you might be in line for a payout. Keep an eye on the FCA’s updates – this could affect millions of drivers.

FAQ

Q1: Who’s eligible for motor finance compensation?

A: Anyone who bought a car on finance and wasn’t properly informed about commission arrangements. The FCA says “large numbers” of consumers were affected, so eligibility could be broad.

Q2: How much compensation can I expect?

A: The FCA estimates around £950 per customer on average. But individual payouts will vary depending on your specific circumstances and the commission involved.

Q3: When will compensation start being paid?

A: The FCA aims to start payments next year once their industry-wide scheme is finalised. The consultation ends in early October 2025.

Q4: Do I need to do anything now?

A: Not yet. Wait for the FCA’s official scheme to launch rather than going through claims management companies that might charge hefty fees.

Q5: Could this make car finance more expensive?

A: Possibly. The FCA is trying to balance fair compensation with keeping lenders in the market. If too many firms exit, competition could decrease and costs rise.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.