Uber UK issued a stark profit warning despite achieving record revenue of £6.5bn in 2024 – a massive £1bn increase from the previous year. Here’s the shocking twist: whilst Uber’s UK revenue jumped 24%, profits actually fell 26% to just £21.6m. The ride-hailing giant now warns it may struggle to maintain profitability in key markets as costs spiral upward.

Uber UK Revenue Surge: The Numbers Behind the Growth

Uber’s UK financial results for 2024 reveal explosive revenue growth across both core divisions:

Uber mobility revenue: Soared from £4.1bn to £5.1bn (+24%) Uber Eats UK revenue: Grew from £1.1bn to £1.3bn (+18%) Total Uber UK revenue: Reached £6.5bn, up from £5.2bn

But here’s where Uber’s UK profitability story gets concerning. Pre-tax profits plummeted from £29.3m to £21.6m – a 26% decline. The reason? Uber’s cost of sales jumped pound-for-pound with revenue, rising from £4.1bn to £5.1bn.

Uber UK also expanded its workforce from 427 to 512 employees, with administrative expenses in Delivery UK becoming the primary profit drain.

Supreme Court VAT Ruling Gives Uber Competitors Major Advantage

Whilst Uber battled rising costs, UK competitors secured a game-changing victory. A landmark Supreme Court ruling means rival taxi operators won’t pay 20% VAT on profits outside London – giving them a significant competitive edge over Uber.

The irony? Uber originally brought this VAT case following a 2021 Supreme Court decision that classified Uber drivers as workers rather than contractors. Uber won initially in the High Court in 2023, which would have forced all operators to pay VAT.

However, rivals Delta Taxis and platform Veezu successfully appealed to the Court of Appeal in July 2024. The Supreme Court’s final ruling now exempts these competitors from VAT obligations that Uber must still meet.

Estonian ride-hailing competitor Bolt also defeated HMRC’s VAT appeal earlier in 2024, though the tax authority continues to challenge the decision.

Uber UK Profitability Concerns: What the Warning Means

Uber’s profit warning for its UK operations is unambiguous. The company states it must “generate and sustain increased revenue levels whilst lowering proportionate expenses” to achieve profitability in major markets.

More concerning, Uber admits that even if successful, “we may not be able to maintain or increase profitability” in the UK market.

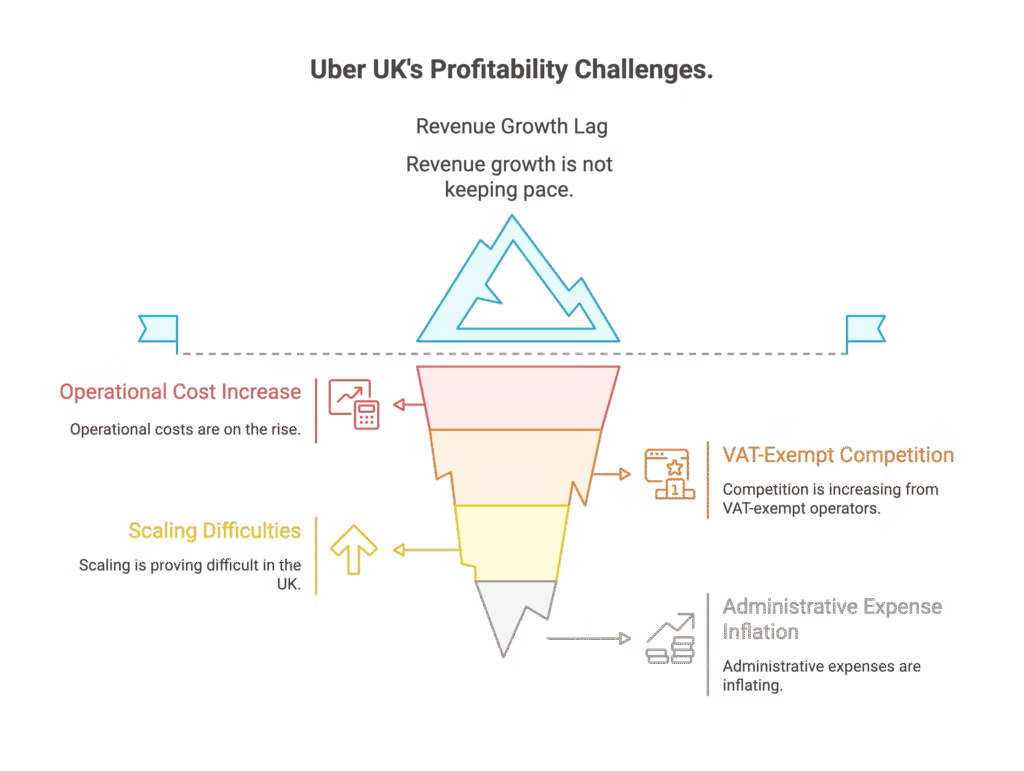

This Uber UK profit warning highlights several critical challenges:

- Rising operational costs outpacing revenue growth

- Increased competition from VAT-exempt operators

- Scaling difficulties in the UK delivery market

- Administrative expense inflation

UK Ride-Hailing Market: Uber Faces Intensified Competition

The UK ride-hailing and food delivery market is becoming increasingly competitive for Uber. With rivals enjoying VAT advantages and Uber’s costs rising faster than revenue, the company faces mounting pressure to optimise operations.

Uber’s UK market position remains strong with £6.5bn in revenue, but profitability challenges suggest the company needs strategic changes to maintain its competitive edge.

Uber UK: Future Profitability Outlook

Uber’s 2024 UK results demonstrate that revenue growth doesn’t guarantee profit growth. With competitors securing VAT exemptions and operational expenses climbing, Uber UK must balance expansion with cost control.

For investors and industry observers, Uber’s profit warning serves as a crucial reminder: in the competitive UK ride-hailing market, sustainable profitability requires more than just revenue growth.

FAQ About Uber UK’s Profit Warning

Q1: Why did Uber UK profits fall despite £1bn revenue increase?

A: Uber’s administrative expenses, particularly in Uber Eats UK operations, grew faster than revenue. Cost of sales increased by exactly £1bn, matching revenue growth but eliminating profit improvement opportunities.

Q2: How does the Supreme Court VAT ruling affect Uber UK competitiveness?

A: Competitor taxi operators outside London now avoid 20% VAT on profits, creating a significant pricing advantage. Uber ironically initiated the legal case but lost when higher courts sided with rival operators.

Q3: Is Uber still profitable in the UK market?

A: Yes, but marginally. Uber UK pre-tax profits fell 26% to £21.6m in 2024. The company explicitly warns it may not maintain profitability given rising costs and increased competition.

Q4; What’s driving Uber UK’s revenue growth in 2024?

A: Increased taxi trips and Uber Eats orders fuelled growth. Mobility revenue reached £5.1bn whilst food delivery hit £1.3bn, but operational costs rose proportionally.

Q5: Could Uber exit the UK market due to profitability concerns?

A: Whilst not explicitly stated, Uber’s warning about evaluating profitability across “largest markets” suggests all options remain under consideration if cost control fails.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.