UK manufacturing PMI plummeted to 47 in August, marking the sector’s worst performance in three months. This downturn signals trouble for Labour’s ambitious manufacturing growth plans as rising costs and declining output threaten the UK’s industrial recovery. With employment falling for ten consecutive months, can UK manufacturing bounce back?

August Manufacturing PMI: Key Numbers Behind the Decline

- PMI: 47 (vs 50 neutral threshold)

- Output: Three-month low

- Employment: 10th consecutive monthly decline

- New Orders: Continued deterioration

The August UK manufacturing data paints a stark picture. S&P Global’s PMI survey reveals manufacturing companies across Britain are struggling with a toxic mix of rising costs and weakening demand for UK manufactured goods.

“August’s final S&P Global UK manufacturing survey provided further signs that the manufacturing sector appears likely to continue to underwhelm,” said EY ITEM Club’s Matt Swannell, highlighting persistent challenges facing UK businesses.

Exports are particularly vulnerable, with trade policy uncertainty dampening international demand for British manufactured products.

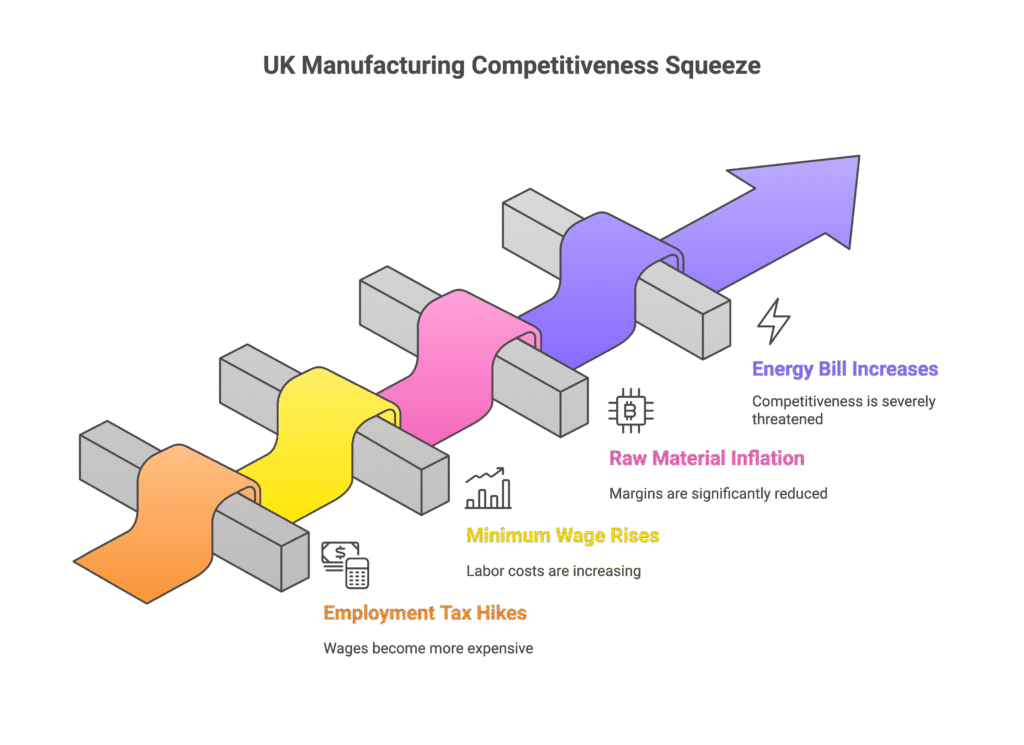

Rachel Reeves Manufacturing Tax Impact: Employment Costs Surge

Rachel Reeves’ Autumn Budget changes are hitting UK manufacturing hard. The Chancellor’s employment tax increases and minimum wage hikes are inflating payroll costs precisely when manufacturing companies need relief.

Key Manufacturing Cost Pressures:

- Employment tax increases affecting manufacturing wages

- Minimum wage rises impacting manufacturing labour costs

- Raw material price inflation squeezing manufacturing margins

- Energy bill increases threatening UK manufacturing competitiveness

Manufacturing redundancies have now persisted for ten months straight—a employment crisis that contradicts Labour’s manufacturing job creation promises. UK firms cite these policy-driven cost increases as major barriers to investment.

Manufacturing business confidence improved marginally in August but remains below historical averages, suggesting CEOs expect continued sector challenges.

UK vs Global Manufacturing: Competitive Disadvantage

While global manufacturing shows mixed signals, UK manufacturing uniquely faces government-imposed cost increases. This policy-driven disadvantage could accelerate job losses and reduce UK market share internationally.

Manufacturing companies planning future operations increasingly worry about:

- Additional tax burdens

- Rising energy costs

- Reduced UK profitability

- Weakened export competitiveness

These sector concerns extend beyond cyclical downturns, suggesting structural challenges within UK manufacturing that require urgent policy intervention.

Make UK Manufacturing Outlook: Strategic Pause or Deeper Problems?

Make UK, the leading UK manufacturing trade body, offers cautious optimism about manufacturing prospects. Senior economist Fhaheen Khan argues current weakness reflects “businesses carefully reviewing their manufacturing growth plans following the government’s industrial strategy announcement.”

This analysis suggests UK companies are strategically repositioning rather than fundamentally declining. However, sustained job losses and falling orders challenge this optimistic narrative.

Manufacturing industry observers remain split on whether this represents temporary adjustment or long-term sector decline requiring comprehensive manufacturing support measures.

Labour Manufacturing Strategy vs Reality

Labour’s manifesto promised manufacturing renaissance through:

- Reduced energy costs

- Enhanced UK productivity

- Increased investment incentives

- Strengthened export support

However, August’s data reveals growing disconnect between policy promises and sector reality. UK manufacturing needs immediate cost relief, not long-term transformation pledges.

Manufacturing PMI surveys historically underperform official ONS statistics, but ten months of employment decline suggests deeper structural issues than seasonal fluctuations.

UK Manufacturing Recovery: What Manufacturing Companies Need Now

UK manufacturing recovery requires urgent action across multiple policy areas:

Immediate Manufacturing Support:

- Tax relief to offset employment cost increases

- Energy bill assistance for cost-intensive operations

- Export finance to maintain international competitiveness

- Accelerated depreciation allowances

Long-term Manufacturing Strategy:

- Skills development programmes

- Technology investment incentives

- Supply chain resilience measures

- Green transition support

Without decisive intervention, UK manufacturing risks prolonged stagnation that could undermine Britain’s manufacturing base permanently.

The sector’s contribution to UK GDP and employment levels make this downturn a critical economic concern requiring immediate policy response.

UK Manufacturing PMI August 2024: Essential FAQs

Q1: Why did UK manufacturing PMI fall to 47 in August 2024?

A: Multiple manufacturing pressures converged: Rachel Reeves’ employment tax increases inflated manufacturing costs while customer confidence collapsed, reducing orders. Trade uncertainty further damaged manufacturing export prospects, creating perfect storm conditions for UK decline.

Q2: How do UK manufacturing PMI figures compare to official manufacturing data?

A: ONS official manufacturing statistics typically outperform manufacturing PMI surveys by 2-3 points historically. However, manufacturing PMI provides earlier sector insights and captures business sentiment more accurately than retrospective official manufacturing data.

Q3: Will UK manufacturing job losses accelerate beyond August?

A: Manufacturing employment has declined for ten consecutive months, suggesting structural challenges beyond cyclical adjustments. Without manufacturing policy intervention, redundancies could accelerate as companies struggle with unsustainable cost increases.

Q4: Can Labour’s manufacturing strategy reverse UK manufacturing decline?

A: Labour’s manufacturing promises include energy cost reductions and productivity enhancements. However, companies need immediate relief rather than long-term transformation. The manufacturing strategy’s success depends on rapid implementation and cost mitigation measures.

Q5: What makes UK manufacturing less competitive than global manufacturing?

A: UK manufacturing faces unique policy-driven cost increases including employment tax rises and minimum wage hikes. These disadvantages compound existing challenges like high energy costs and post-Brexit trade complications, weakening UK manufacturing competitiveness internationally.

Q6: Which UK manufacturing sectors are worst affected by the PMI decline?

A: While sector-specific manufacturing data wasn’t detailed, industries with high labour costs and energy usage face greatest pressures. Export-dependent manufacturing companies also struggle more with trade uncertainty affecting international demand.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.