Ever wondered what it’s like when a law firm has a really good year? Just ask Linklaters partners – they’re about to find out firsthand.

The magic circle law firm just smashed through the £1bn profit barrier for the first time in its 187-year history. That’s not just a milestone; it’s a statement. With pre-tax profits hitting £1.08bn (up 14% year-on-year), Linklaters is proving that high-stakes legal work still pays handsomely.

Here’s what’s driving this profit surge and why it matters for the broader legal market.

Partners Hit the Jackpot with £2.2m Payouts

Let’s cut straight to the number everyone wants to know: partner pay.

Linklaters partners are set to pocket an average of £2.2m each – a sweet 15% bump from last year. That’s the kind of raise that makes other professionals wonder if they picked the wrong career path.

The firm’s revenue also climbed 11% to £2.32bn, showing this isn’t just about squeezing margins. They’re genuinely growing the pie, not just slicing it differently.

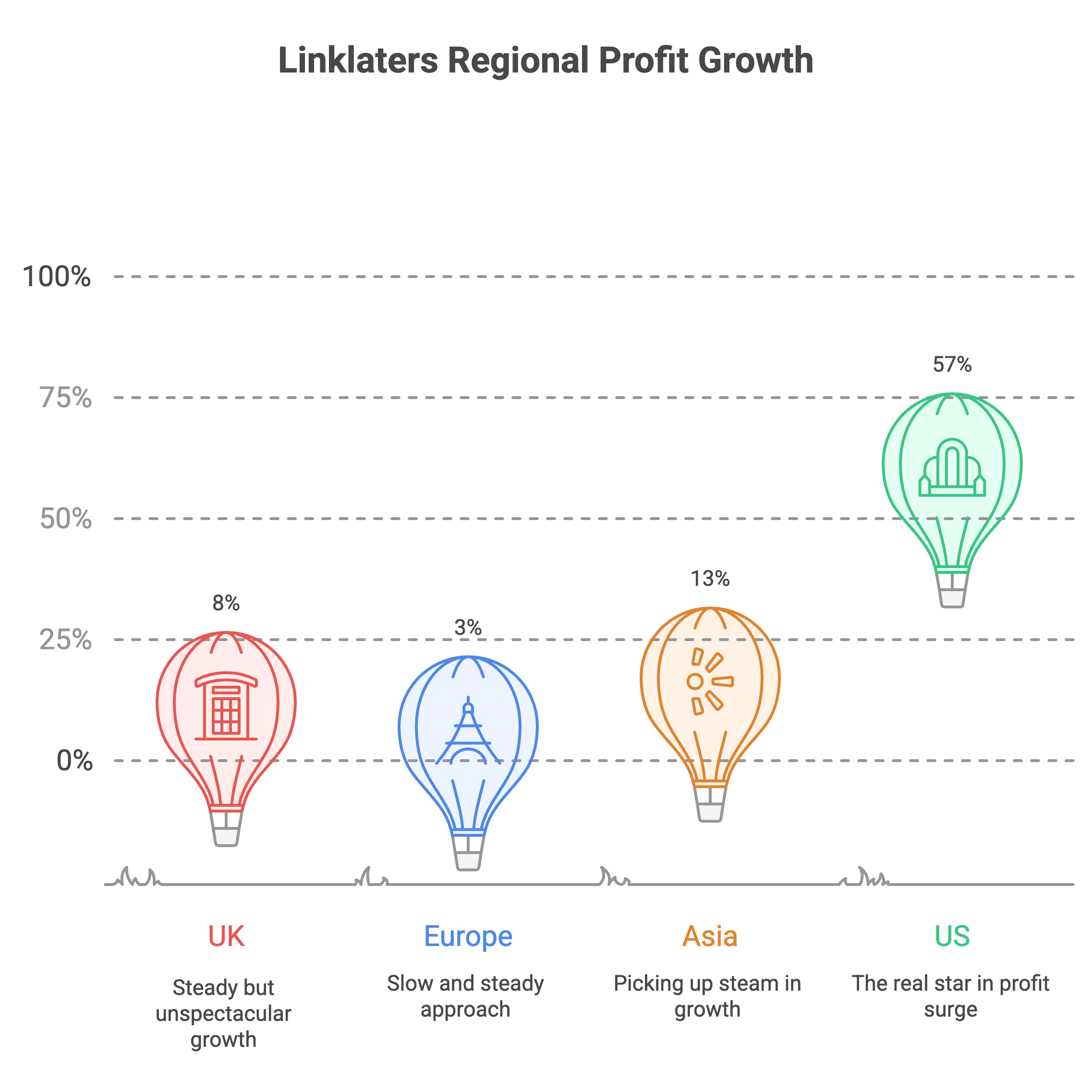

Geographic Breakdown: US Steals the Show

While Linklaters saw solid growth across all regions, the numbers tell a story:

- UK: 8% profit increase (steady but unspectacular)

- Europe: 3% growth (the tortoise approach)

- Asia: 13% jump (picking up steam)

- US: 57% surge (the real star)

That US number isn’t a typo. American legal work is where the firm’s seeing explosive growth, reflecting the ongoing transatlantic M&A boom and complex cross-border deals.

Deal-Making Machine: $211bn in Transactions

Linklaters’ corporate practice handled some serious firepower in 2024.

The firm advised on $211bn worth of deals, including heavyweight transactions like Dow’s $6bn partnership with Macquarie Asset Management and Volkswagen’s $5.8bn joint venture with Rivian. They also guided Carrier through its $3bn fire business sale and helped Unilever carve out its ice cream division.

These aren’t just big numbers – they’re the kind of complex, cross-border mandates that separate magic circle firms from the pack.

Strategic Expansion: 61 New Partners

Linklaters didn’t just grow profits; they grew their partnership too. The firm made 27 lateral partner hires and elected 34 new partners globally.

That’s aggressive expansion by law firm standards, suggesting they’re betting big on continued growth rather than just milking existing client relationships.

Managing partner Paul Lewis called it part of their “clear vision” to win the most complex mandates for leading corporates and financial sponsors. Translation: they’re doubling down on being the go-to firm for deals that make headlines.

What This Means for the Legal Market

Linklaters’ record year reflects broader trends in the legal industry. Complex regulatory environments, cross-border M&A activity, and high-stakes corporate restructuring are creating premium demand for top-tier legal advice.

The firm’s geographic performance also highlights where the action is: US markets are driving growth, while traditional European strongholds are growing more steadily.

For other magic circle firms, Linklaters just raised the bar. Expect similar profit announcements as competitors report their own results.

FAQ

Q1: What makes Linklaters a “magic circle” law firm?

A: The magic circle refers to London’s five most prestigious law firms: Linklaters, Allen & Overy, Clifford Chance, Freshfields, and Slaughter and May. They’re known for handling the biggest, most complex international deals and commanding premium fees.

Q2: How does £2.2m partner pay compare to other top law firms?

A: It’s competitive but not the highest. Some US firms pay equity partners $3m+, but Linklaters’ figure represents strong performance for a UK-headquartered firm with global reach.

Q3: Why did US profits surge 57% while other regions grew more modestly?

A: The US market has seen intense M&A activity, complex regulatory deals, and high-value corporate restructuring. American clients also tend to pay premium rates for specialised legal work.

Q4: What types of deals drive the highest profits for magic circle firms?

A: Cross-border M&A, complex financing arrangements, regulatory investigations, and major corporate restructuring typically generate the highest fees. These require specialised expertise and carry significant client risk.

Q5: Is Linklaters’ growth sustainable given economic uncertainty?

A: While economic headwinds could impact deal flow, complex legal work often increases during uncertain times as companies navigate regulatory changes, restructuring, and defensive strategies.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.